Building Trust Online: Best Practices for Loan Officers

How Loan Officers Can Build Trust and Connect with Clients Digitally

Establishing trust online is essential for loan officers who aim to attract and retain clients. Potential borrowers frequently research loan options and officers online, making it crucial to convey credibility and reliability through your online presence. This article delves into effective strategies for building trust, including showcasing expertise through social media and newsletters, providing detailed personal and contact information, and maintaining consistent branding. By implementing these practices, loan officers can create a strong, trustworthy image that sets them apart in the competitive market.

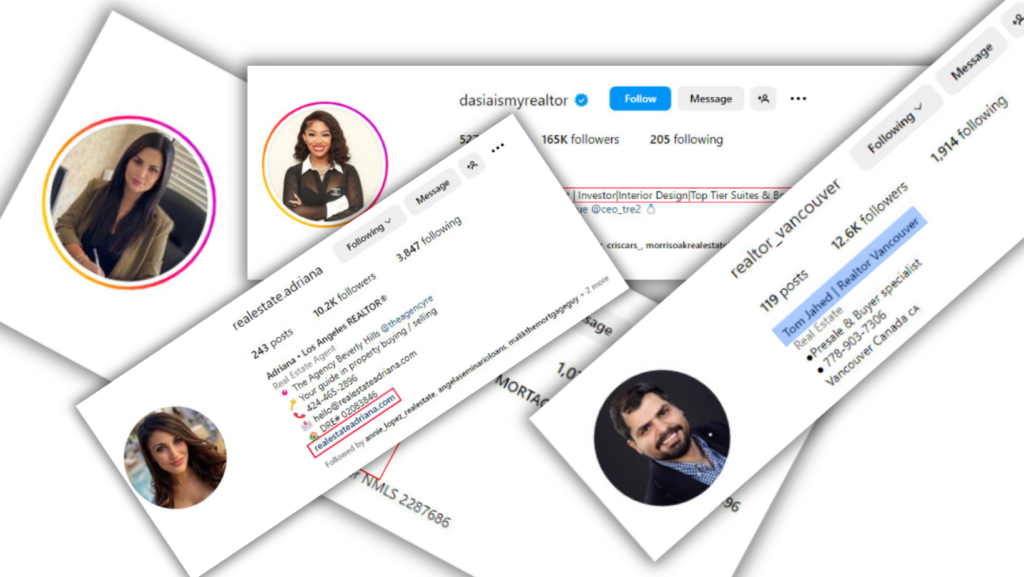

Detailed Information About Yourself

Providing detailed information about yourself on your social media profiles can significantly enhance trust and facilitate easy contact. Ensure that your profiles include:

- About You: Share your professional background, experience, and expertise in the loan industry. Highlight your qualifications and any specializations.

- Area of Service: Clearly mention the geographical areas you serve, helping potential clients understand if you are the right fit for their needs.

- Contact Information: Make your contact details easily accessible. Include your phone number, email address, and links to other social media profiles. Consider adding a direct messaging option for quick inquiries.

- Professional Achievements: Showcase any awards, recognitions, or significant milestones in your career to build credibility.

Having this information readily available on your social media profiles facilitates easy communication and reassures potential clients of your professionalism and accessibility.

Clear and Transparent Information

Transparency is key to building trust. Provide clear, detailed information about your services, loan options, and the loan process. Include:

- Detailed Service Descriptions: Clearly outline the types of loans you offer and their benefits.

- Step-by-Step Process Guides: Explain the loan application process in simple terms.

- FAQ Section: Address common questions and concerns potential clients might have.

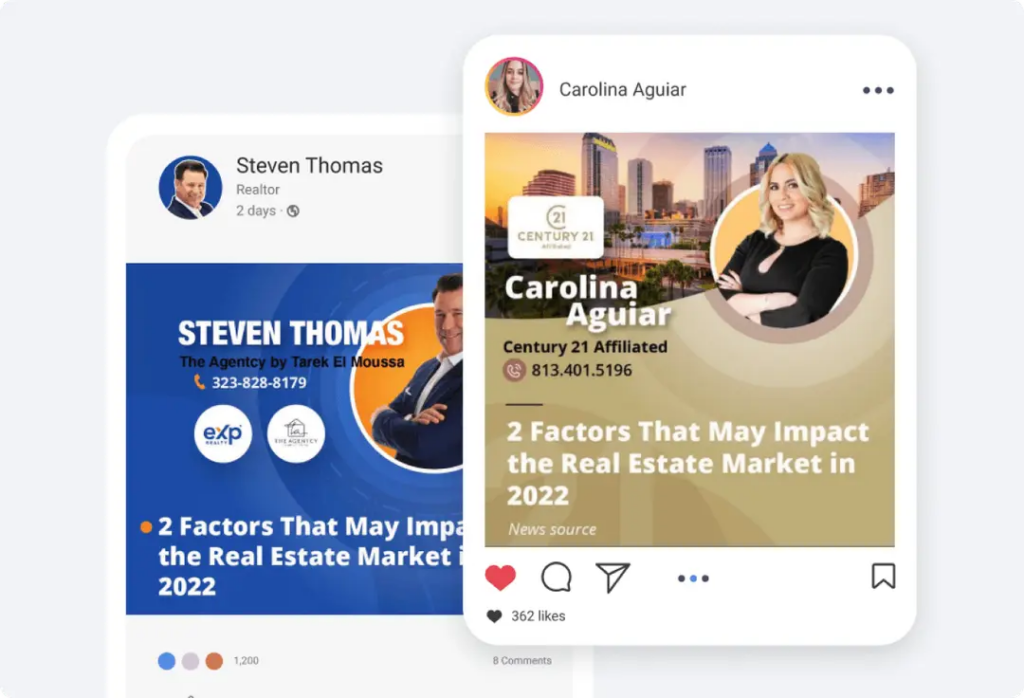

Consistent Branding

Consistency in branding is key to establishing and maintaining trust with your audience. A cohesive and recognizable brand helps potential clients feel confident in your professionalism and reliability. Here are some tips for building trust through consistent branding:

- Visual Identity: Ensure that your logo, color scheme, fonts, and overall design elements are uniform across all platforms, including your website, social media profiles, and marketing materials. This visual consistency helps clients easily recognize your brand.

- Brand Voice: Maintain a consistent tone and style in all your communications. Whether writing social media posts and newsletters or responding to client inquiries, your brand voice should reflect your professionalism and expertise.

- Messaging: Keep your core messages consistent. This includes your mission, values, and the unique selling points of your services. Reiterate these key messages across different content types to reinforce your brand identity.

- Content Quality: Ensure that all the content you share, from social media updates to newsletters, is high quality and aligns with your brand standards. High-quality, informative content demonstrates your commitment to excellence and builds trust.

- roomvu’s Branding Solutions: Utilize roomvu’s marketing solutions to maintain consistency in your branding efforts. Roomvu’s tools can help you create branded videos, newsletters, and social media content that align with your brand identity, ensuring a professional and cohesive appearance.

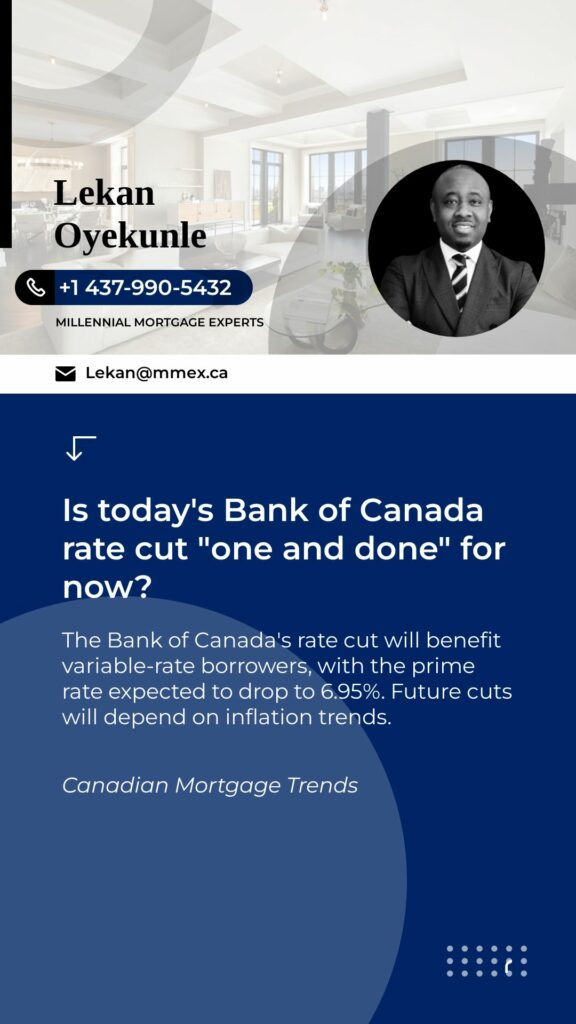

Showcase Expertise through Content

Establish yourself as an authority in the field by creating and sharing valuable content on social media and through newsletters. This can include:

- Social Media Content: Share market report videos, tips for loan applicants, and explanations of complex terms on platforms like Facebook, LinkedIn, and Instagram. Use roomvu’s hyper-local and relevant video content to keep your audience informed and engaged. Educating your audience shows that you know what you are doing and is one of the best ways to gain trust.

- Newsletters: Regularly send newsletters with detailed, transparent information about your services, industry updates, and financial advice. Utilize roomvu’s automated newsletters to ensure consistent and valuable client communication. Educating your audience through these newsletters further establishes your expertise and builds trust.

Client Testimonials and Reviews

Positive feedback from satisfied clients can significantly enhance your credibility. Collect and showcase testimonials and reviews on your website and social media profiles. Consider:

- Video Testimonials: These can be particularly powerful, as they add a personal touch.

- Case Studies: Share detailed stories of how you’ve helped clients achieve their financial goals.

- Review Platforms: Encourage clients to leave Google My Business and Yelp reviews.

Engage on Social Media

Social media platforms offer an excellent opportunity to connect with potential clients and showcase your personality and expertise. To build trust through social media:

- Consistent Posting: Share regular updates, including tips, news, and success stories.

- Respond Promptly: Engage with comments and messages promptly to show that you’re accessible and responsive.

- Professional Profiles: Ensure your profiles are complete and up-to-date, with professional photos and contact information.

Offer Exceptional Customer Service

Providing outstanding customer service online can set you apart from the competition. Focus on:

- Accessibility: Make it easy for clients to reach you via phone, email, or chat.

- Timeliness: Respond to inquiries and follow up on leads promptly.

- Personalization: Tailor your communication to each client’s needs and preferences.

Conclusion

Building trust online as a loan officer requires a combination of professionalism, transparency, and engagement. By focusing on these best practices, you can create a credible and trustworthy online presence that attracts and retains clients. Investing in trust-building strategies is essential for long-term success in a digital world where first impressions are often made online.