Are Vancouver’s insane housing prices and tight mortgage rules pushing buyers to look for houses with a basement suite? Houses with ‘mortgage helpers’ in Greater Vancouver sell for $34,000 more and 4.5 days faster

Greater Vancouver housing prices are among the highest in North America due to factors like proximity to natural beauty, accessible outdoor recreation, and a temperate climate. Buying a house in the Metro Vancouver region is generally considered desirable—if it can be afforded.

The Federal government’s recent announcement regarding the new benchmark rate for qualifying insured mortgages might help make buying a home in Vancouver and across the country more affordable by increasing Canadians’ purchasing power. While it’s too early to determine the effects of the new mortgage rules, we thought it worthwhile to look at whether homes with rental basement suites increase purchasing power when buying a house.

It seems that many people are looking for those properties with suites (legal or not—usually basement suites) that can be rented out to generate income to help pay for mortgage costs. Some realtors have appropriately termed these suites ‘mortgage helpers’—and the term itself appears to have a real marketing impact for most houses.

We at Roomvu have compared houses with a mortgage helper or rentable suite against those that do not. We looked at terminology used by realtors in public remarks for each listing and split houses into categories of having or not having a mortgage helper; we then looked at the sale price and average days spent on market across Metro Vancouver for both groups.

Houses in our comparison are 20 years old or older with floor areas of between 1,500 and 3,000 sq ft; lot sizes were between 4,000 and 6,000 sq ft. This is designed to avoid having newer or larger houses and different size properties affect our findings.

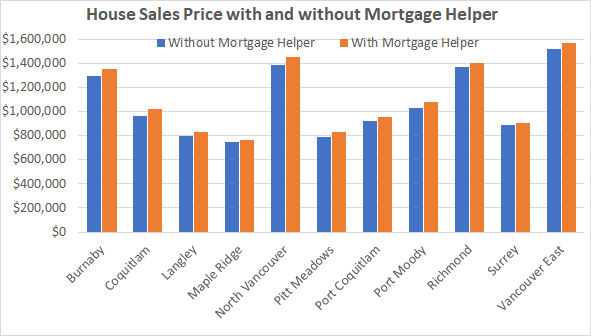

It is clear in this figure that in every Metro Vancouver municipality we looked at, houses with a mortgage helper are being sold at higher prices than those without. The price difference is about 1-6 percent depending on the municipality. It appears that any basement suite—legal or unauthorized—that helps pay the mortgage is of interest to the buyer.

The houses examined—within the aforementioned specifications pertaining to age, floor area and lot size—are being sold for approximately $1.203 million without a mortgage helper and $1.237 million with a mortgage helper. This would suggest that, on average, a mortgage helper can increase the average home price by about $34,000. It is important to note that houses at the lower-end of the price range ($700,000) in Maple Ridge and Langley are included in the comparison. Houses in the Vancouver-West area (within Vancouver city-proper, west of Main street) were not included in the comparison due to the specific types of home-buyers in this part of the city. Data from the last three years were used for the analysis.

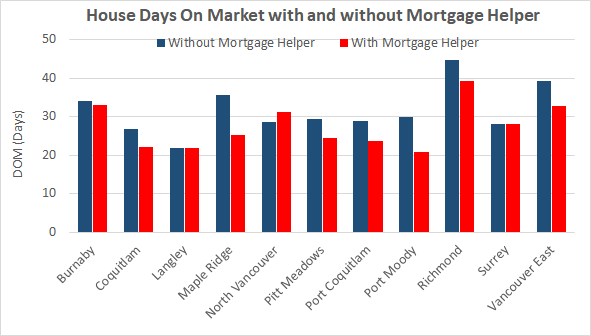

The second Figure compares the difference in number of days on market (before being sold) among homes with and without a mortgage helper. Much like in Figure 1, we see in Figure 2 that homes across Metro Vancouver with a mortgage helper sold quicker than those without. It’s important to note, however, higher prices—like those associated with homes with mortgage helpers—can have an impact on the time it takes to sell a home.

Regardless, the data show that homes with a mortgage helper are indeed being sold quicker. Exceptions can always be found in these types of analyses due to the myriad different parameters affecting the real-world behaviour of buyers and sellers. The houses in Figure 2 sold, on average, within 34 days without a mortgage helper, and 29.5 days with a mortgage helper. Suggesting that homes with a mortgage helper sold about 4.5 days quicker than those without.

The average median income in BC is $69,995 or almost $70K based on 2016 Census. So an average couple living in the cities around makes $140K per year. Imagine Jane and Adam are buying a house in Port Coquitlam or Surrey at $900K at 20% down payment ($180K). They ask their mortgage broker to find them a mortgage for $720K of the remaining price. In this scenario the family needs to have a total income of $140K per year to qualify for a mortgage at 5.19% qualification rate and to be approved for this, assuming a $2500 yearly tax (with all applicable grants). If your house includes a basement suite you could rent at 1600$ per month as a mortgage helper, your purchase power regarding the new income would be increased to $1,175,000. This is a $275,000 raise to your previous purchase power which makes you pay more to prefer a house with a basement suite over the one without it. We saw that based on this, average Vancouverites pay up to 34,000 more to find a buy such a house.