Vancouver Apartments Took Twice As Long to Sell During Covid – Demand is shifting to detached in the Chilliwack area – UBC Study finds

Summary

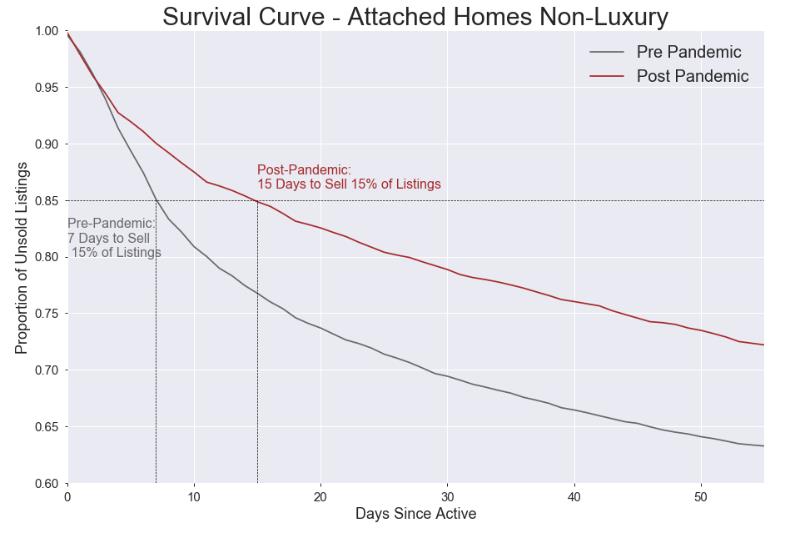

- Attached homes, particularly in the non-luxury segment, are taking more than twice as long to sell as social distancing has made accessing apartments for viewings more difficult

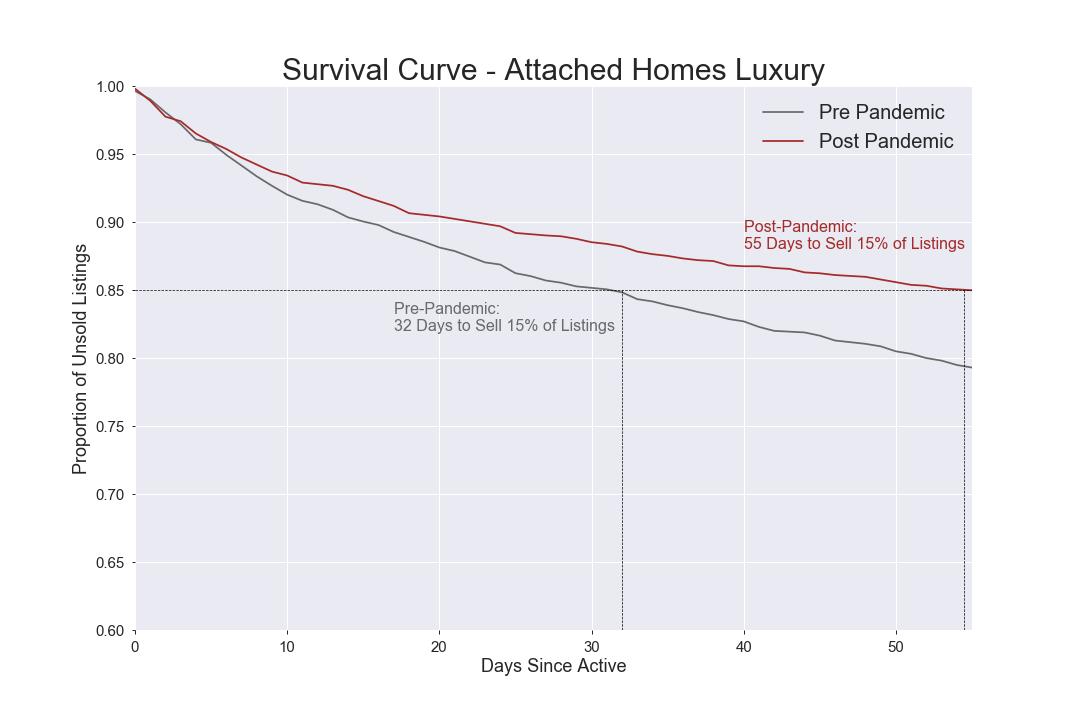

- The average times on market for attached homes increased by 114% in the non-luxury segment and 72% for the luxury segment. For detached homes, the increase in duration is more modest at 45% for non-luxury and 39% luxury segments.

Anyone who has bought or sold a home knows just how complex the process can seem. Between finding the right property, finding the right people to buy or sell a property, and perhaps hardest of all closing the deal, buying or selling a home can seem like a never-ending endeavour. Covid-19 has presented even more challenges in this pursuit. Physical distancing requirements and daily increases in confirmed infections have led homeowners and prospective home buyers to be more hesitant when it comes to in-person showings. What’s more, open houses, which can often generate multiple leads, are no longer an option — leaving realtors with fewer levers to pull on.

Similar reversal in preference is observed by Thomas Davidoff, economist and professor from the UBC Sauder School of Business. “The big loser is non-luxury apartments. All sectors have been stronger than you may have seen in the recession, but that is not the only thing surprising. COVID impacted the apartment sector the most, which makes sense given that people’s preferences are shifting to the detached home.

So, how has Metro Vancouver’s real estate market been affected by the pandemic? With the help of UBC’s Sauder School of Business, the data science team at ROOMVU has attempted to better understand the full extent of Covid-related impacts on Vancouver’s real estate market. Previous reports have shown a worrisome trend of decreasing median property prices, coupled with an overall slow-down in market activities.

While less than stellar sales activity is to be expected given the current economic uncertainty and social distancing policies, the results of the analysis showed a stunning trend. The market for apartments, which were selling like hotcakes before the pandemic, turned out to be the unexpected loser in the current environment — especially luxury apartments. Since mid-March, when Covid-19 officially developed into a full blown lockdown, apartments have taken more than twice as long to sell.

Apartment Trend

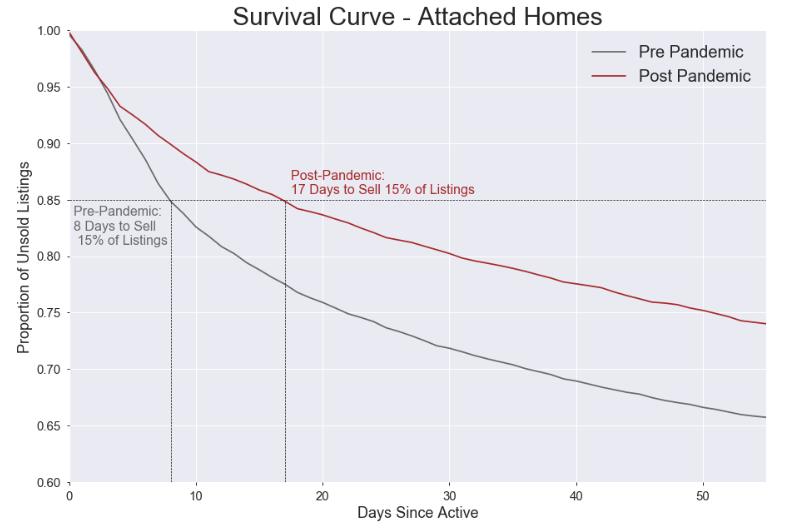

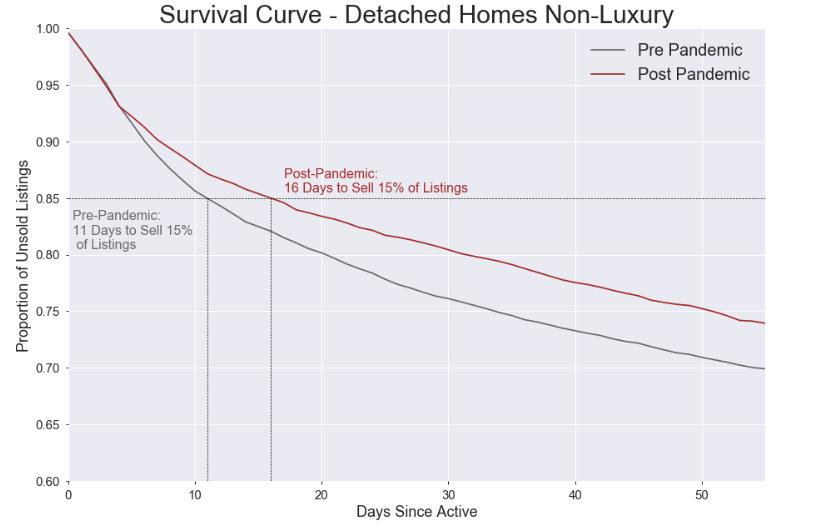

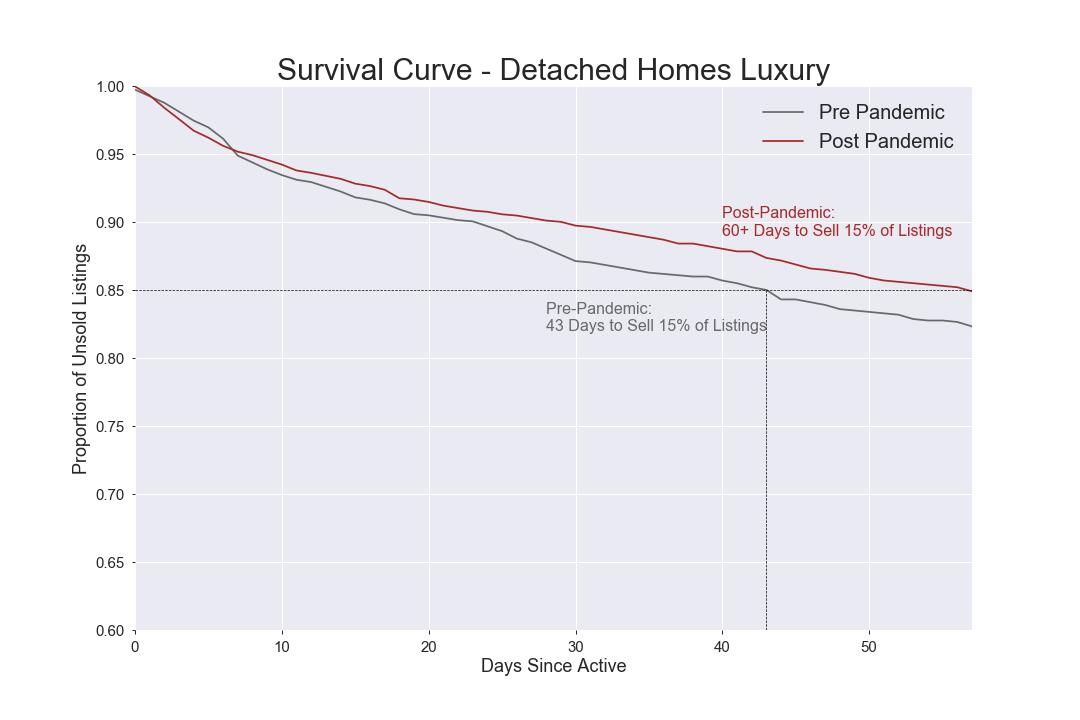

Figure 1 shows the proportion of unsold listings of attached homes since the time they became active. For a deeper look into the extent of the pandemic’s impact on the attached housing market, the number of days it took to sell 15% of active listings before and after March 15 was measured. This metric helps take into account the overall lower number of listings during the pandemic.

As it turns out, Covid’s impact on apartment sales were stark. From January 1 and March 15, it took an average of only 8 days for 15% of listed attached homes to sell. Since March 15, that number has more than doubled to 17 days. In other words, it’s taken twice as long to sell an apartment since British Columbia’s lockdown began.

The luxury segment of the attached housing market was even harder hit. It’s understood among real estate observers that luxury properties take longer to sell, as the high price reduces the pool of available buyers. However the pandemic’s economic and social effects have taken this reality to a different level. While it took only 7 days to sell around 15% of luxury apartments listed before March 15, that number increased to nearly 60 days in the period since. The lag in time has caused a concerning build-up of inventory in the luxury segment.

Single Family Home Trend

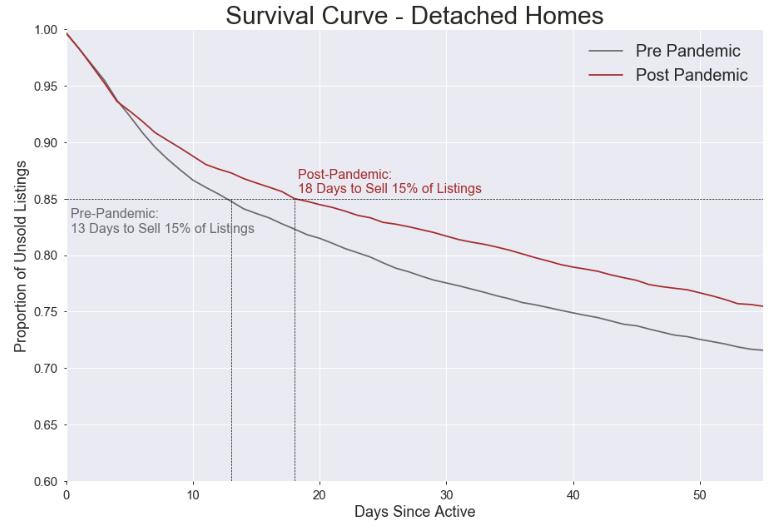

The detached home market in Greater Vancouver has not come away unscathed from the bite of the pandemic either — but it has suffered a far better fate than attached homes. It took on average 13 days to sell 15% of listed detached homes in the pre-Covid period. Since March 15, that number shot up 38% to 18. That means the amount of time it now takes to sell a single-family home and an apartment are nearly identical. (Detached homes normally take longer to sell due in part to higher prices.)

Like luxury apartments, luxury detached homes have started taking longer to sell. In fact, the single family luxury home market is the slowest moving market of them all. It now takes more than 60 days on average to sell just 15% of listings, compared to 43 days before March 15 — a 40% increase. Of course, this pales in comparison with the steep increase in time it now takes to sell a luxury apartment.

Chilliwack

Amidst the bleak picture of the post-COVID market, our team uncovered one bright spot in Greater Vancouver. While the other areas are languishing, the sub-market in Chilliwack continues to grow seemingly immune to the adverse effect of the pandemic. In fact, Chilliwack seems to be doing slightly better during the pandemic than before.

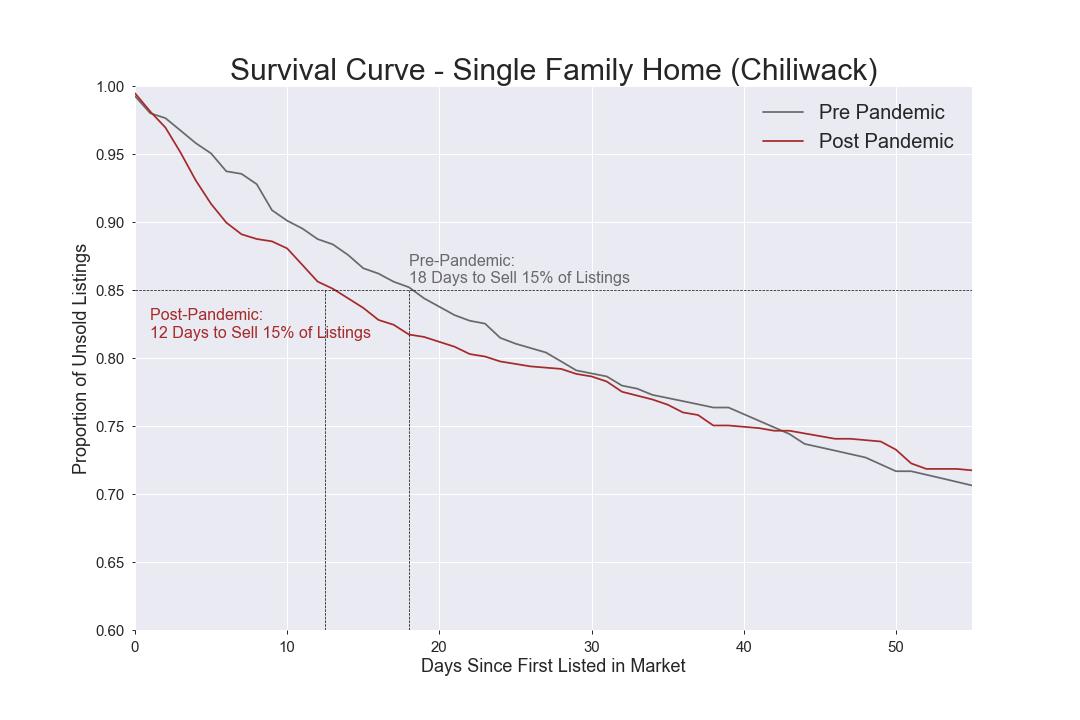

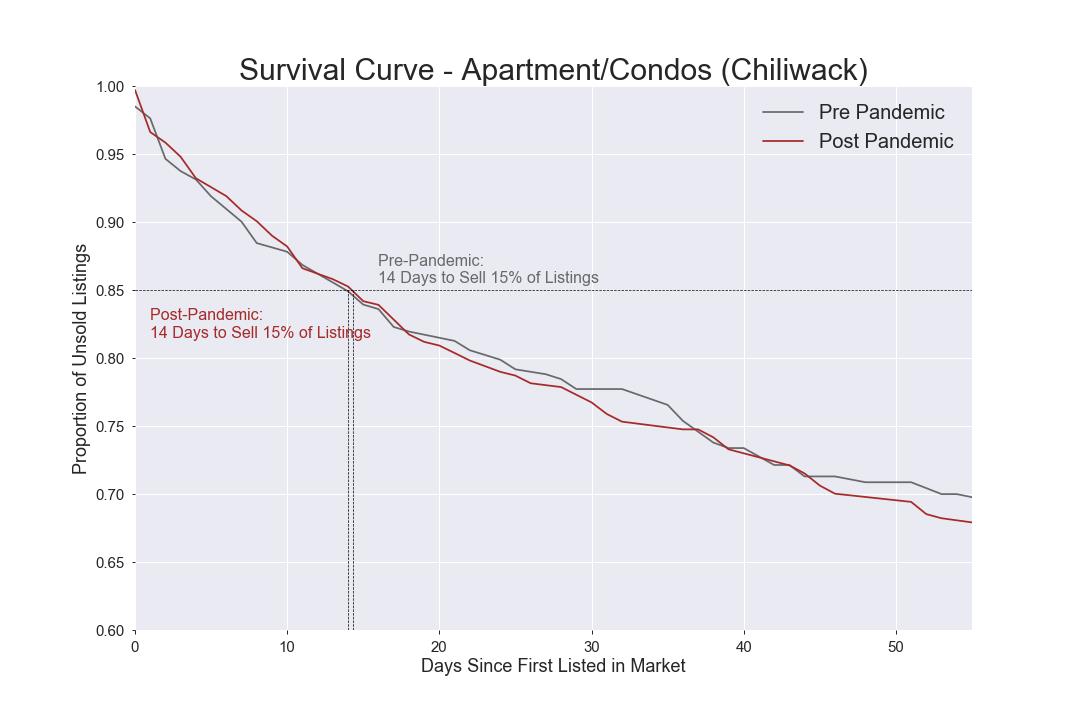

Our data indicate that properties in Chilliwack seem to be taking significantly shorter to sell. The time required to sell 15% of total listings of detached decreased from 18 days pre-pandemic to only 12 days post-pandemic (Figure 7). To a lesser degree, a similar effect is also observed in the market for attached homes in Chilliwack. The time needed to sell 15% of listings of attached homes in Chilliwack remain nearly static at 14 days from both pre and post-pandemic period, despite the additional difficulty in facilitating the sales of attached homes while maintaining proper social distance (Figure 8).

A similar reversal in preference towards detached homes is also observed more markedly in the post-pandemic Chilliwack, where detached homes are selling faster than attached.

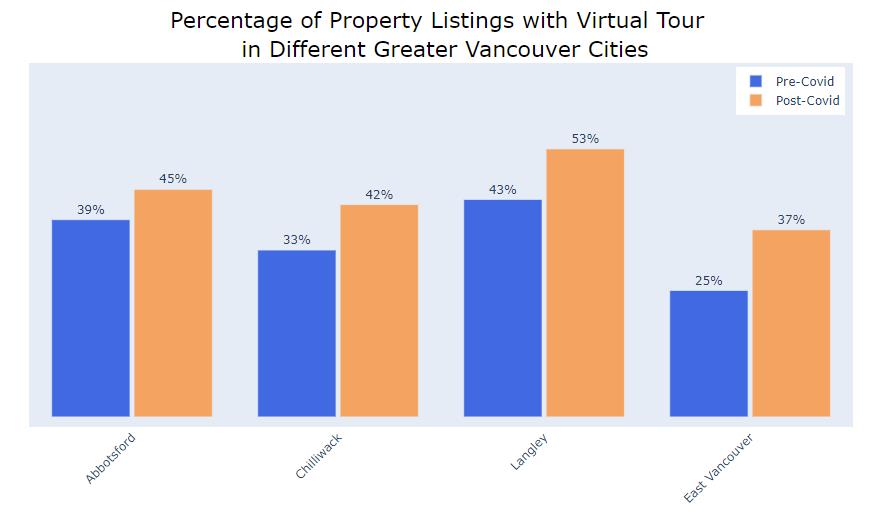

A possible explanation for the phenomenon could be a combination of two factors in property pricing and virtual tour adoption. Compared to other benchmarked areas, properties in the Chilliwack area are much for reasonably priced. This combined with a significantly higher adoption of virtual tours in the area could result in a more favorable market condition that helps to sell homes in Chilliwack.

Conclusion

The analysis confirms what many observers of Vancouver’s real estate have suspected. It is becoming much more difficult to sell real estate in the post-COVID period — due largely to social distancing’s impacts on traditional means used by realtors to entice prospective buyers. Stand-outs with respect to underperforming segments of the market were apartments and condos, which are now taking twice as long to sell.

Additionally, as the gap in the length of time between selling apartments and single-family homes has narrowed and nearly closed, realtors may start to prefer selling single-family homes given their higher prices. With the impacts of the pandemic likely to loom for the foreseeable future, effects like these will start to multiply.

As the risk of the pandemic continues to loom over the horizon, realtors may need to be especially wary in considering which sub-market segment they should operate in. Realtors will have to leverage virtual tools, and create new ones, to come up with new strategies to sell homes and cope with the current landscape. There are buyers out there—but they are fewer and further between. Therein lies the challenge.

Data & Methodology

The above analysis was conducted using the Kaplan-Meier Survival Analysis with data from MLS listings in the Greater Vancouver area. The cutoff for pre- and post-Covid periods is March 15th. Our data encompasses properties listed from January 1st, 2020 to June 10th, 2020. The last two weeks were removed from the sample to account for the delay in which closed sales are reported in the MLS database. Each group of samples includes listings that were active at the start of the observation period and any listings that are added during the observation period. For more information on our approach, further readings on survival analysis are available.

The following criteria was considered to define “luxury” properties. Different criteria are necessary for Vancouver West and West Vancouver, where home prices are typically higher.

West Vancouver and Vancouver West Luxury Criteria:

- Detached homes: Assessed value of 2.2M CAD and above

- Attached homes: Assessed value of 1.2M CAD and above

Other Areas Luxury Criteria:

- Detached homes: Assessed value of 1.5M CAD and above

- Attached homes: Assessed value of 0.9M CAD and above