This means that if you have no other debt and your average household income is over 120000 to 140000. Alternatively, your house in port Coquitlam becomes about 4 years newer. We know this is probably not what you were expecting from the news.

British Columbia province experienced one of the world’s largest modern house price booms over the past two decades, resulting in what many consider to be an affordability crisis. In response to the perceived affordability crisis, federal and local governments implemented policies designed to bring down the cost of housing. Levers like increasing the minimum downpayment for mortgages, lengthening times for permit processing and the introduction of a foreign buyers’ tax were all pulled on to make homeownership more attainable and less burdensome.

One of these policies, known as the Stress Test, was introduced by the Federal Liberals at the beginning of 2019 to tighten mortgage plans and shrink the buying power of potential homebuyers in the market. As a result of this policy, anyone applying for a mortgage had to meet a higher threshold proving that they would be financially solvent in the event that interest rates were to substantially rise above their mortgage rate. This also meant that some potential buyers were able to access less money than they could have before the Stress Test.

After two years of evaluating the effects of the Stress Test, this week Federal Finance Minister Bill Morneau announced a new benchmark rate for qualifying insured mortgages—in other words, the new stress test rates. The new rules, which will come into effect on April 6, 2020, define a new benchmark rate equal to the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

In practice, this means that if under the old rules you would have been approved for a 5.19% insured rate—the current rate at Canada’s big banks—as of April 6th, 2020 you would need only be approved for 4.89% (2.89% which is your actual mortgage rate plus 2%). Ultimately, the new rules result in an increase to your buying power.

Data analysts at ROOMVU have looked to evaluate the effect of the new policy with respect to the buying power of those in the Vancouver area.

For a couple with a total combined income of $160,000, the highest house price that could be afforded based on a 15% down-payment at the new and old insured rates (4.89% and 5.19%) are $985,000 and $957,000 respectively. This means that under the new regulation, this imaginary couple could be approved for a house worth $28,000 more than they would have under the old regulations.

To delve deeper, the data scientists at ROOMVU analyzed houses in different Metro Vancouver cities matching the prices of $985,000 and $957,000 to determine what benefits this difference in price would yield to a purchaser operating under the new Stress Test.

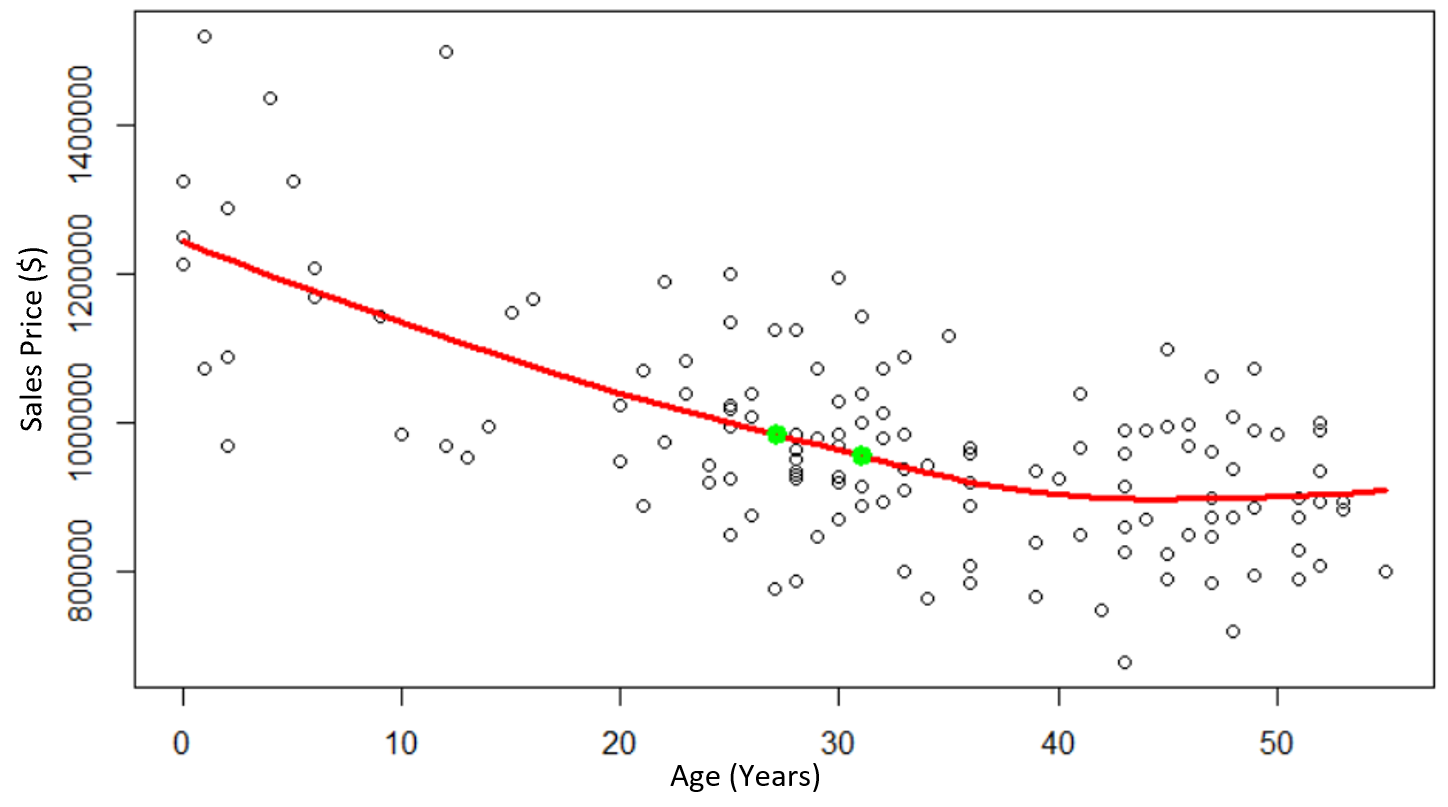

Table 1 illustrates some of these differences. The houses are from different Metro Vancouver cities and feature floor area between 2,000 and 4,000 square feet and lot sizes of 4,000 to 8,000 square feet, determined as the average house size in these areas.

| City | House Age on different Insured Stress Test Rates | |

| Old Rates | New Rates | |

| Maple Ridge | 9 years old house | 6 years old house |

| Port Coquitlam | 31 years old house | 27 years old house |

| Surrey | 35 years old house | 32 years old house |

The data show that under the new rates, one could purchase a home 3-4 years newer in Maple Ridge, Port Coquitlam and Surrey. Given a home’s correlation to its age, it is evident that the updated Stress Test would allow for a newer home to be purchased with the same amount of money.

It is worth noting that in order to calculate the above table the home price in the selected city and with the aforementioned conditions were plotted against the age of the building. After which the previous and new price affordable to the buyers were tagged in the vertical axis and the corresponding ages were determined for each as demonstrated in the shape below.

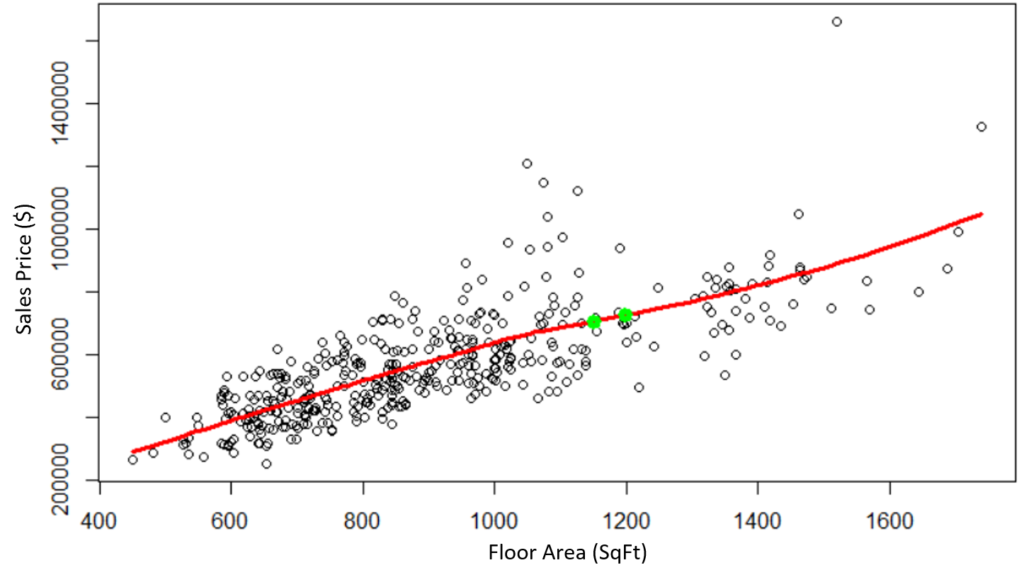

ROOMVU also examined how the new rate would translate into apartment purchasing in different cities. In this case, floor area by apartment by examined as opposed to the age of the home, as floor area was determined to be more meaningful in this particular analysis. Specifically, the question is: to what extent do the new rates allow purchasers to buy a larger apartment.

For a couple with a total combined income of $120,000, the highest apartment prices afforded based on a 15% down-payment approved under the new and old insured rates (4.89% and 5.19%) are $725,000 and $706,000 respectively. In other words, a couple in this situation could afford an apartment worth nearly $20,000 more under the new restrictions.

Looking at apartments smaller than 2,000 square feet sold in 2019 with prices under $2 million located within buildings between 20-50 years old were chosen to illustrate the differences in square footage.

| Scenario | City (Area) | Apartment Floor Area Based on Approved Stress Test Rates | Difference | |

| Old Rates | New Rates | |||

| 1 | Vancouver East | 828 SqFt | 846 SqFt | + 18 SqFt |

| 2 | North Vancouver | 1150 SqFt | 1198 SqFt | + 48 SqFt |

| 3 | New Westminster | 1510 SqFt | 1548 SqFt | + 38 SqFt |

The results: A couple with a total income of $120K living in Vancouver East could have afforded an apartment with an average floor area of 828 SqFt under the old insured rates, while under the new rates they could be approved for an apartment larger by almost 18 square-feet (846 SqFt). A couple with the same income looking for an apartment in North Vancouver would be approved for an apartment with an average floor area of 1526 SqFt and 1695 SqFt before and after the new rates respectively. In New Westminster, the difference is even larger, at 48 SqFt.

In order to calculate the above table, the apartment’s price in the selected city and with the aforementioned conditions were plotted against the floor area of the unit. Then the previous and new price affordable to the buyers were tagged in the vertical axis and the correspondent floor areas were determined for each as shown in the shape below.

Government intervention in the market will always be a contentious issue for economists and policy-makers alike. Some will argue that political intervention in the free-market distorts it and causes it to behave in deleterious ways that might have been avoided had the government not intervened in the first place. Others will argue that no markets are truly “free” and therefore intervention on the part of the government is needed in order to correct market excesses.

No matter where one stands on the issue, what’s clear from the data is that the recent changes in Canada’s mortgage stress test will increase the purchasers ability to find a newer house, and a bigger apartment. Both of which are likely to be appealing to any prospective buyer, no matter how much government intervention they wish to see in the market.