- San Francisco’s Bay Area has experienced one of the largest COVID-19 real estate market slow-downs in the US. Sales of existing, single-family homes in April dropped 37.4% YoY.

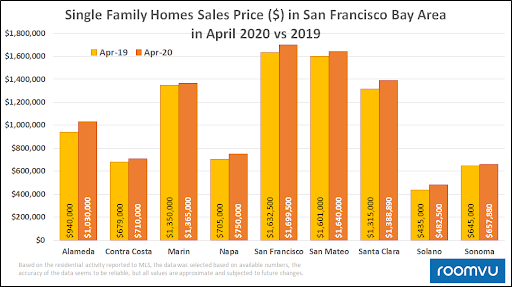

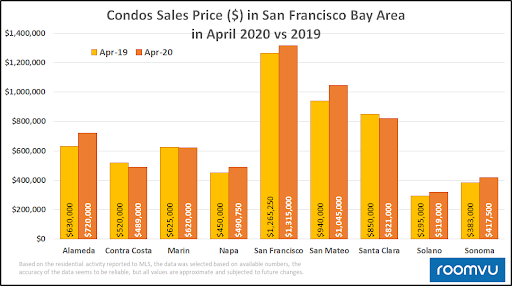

- Median prices were mostly unchanged or became slightly higher in April compared to the same period last year.

- Realtors have begun adjusting the new COVID reality by figuring out how and when to safely show listings to prospective buyers, using virtual tours as a way to weed out less-serious buyers, and leveraging technology to review and accept inspections, perform appraisals, closing, and other requirements.

- Employees being forced to work from home have adapted to this new way of working, making commercial real estate in densely populated downtown areas less-attractive, and making residential homes with extra rooms for home-office space in less expensive suburbs more attractive.

The effects of the COVID-19 pandemic on real estate markets have been evaluated and discussed at length by market observers. For our part, roomvu has published articles looking at the future of real estate, as well as COVID-19’s impact on accelerating the use of digital tools like virtual tours.

The outbreak and stay-at-home orders enacted by state and federal authorities have resulted in significant changes to day-to-day operations and the overall health of several sectors of the economy. With respect to the real estate industry, negative impacts have been characterized by a significant reduction in on-site home viewings, as well as the number of listings and overall sales.

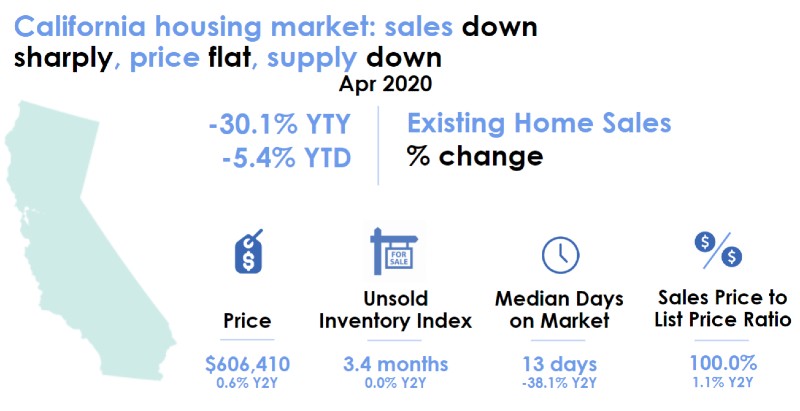

Despite this, home prices have not decreased significantly. In fact, in California, they have remained mostly the same, showing a modest 0.6% increase year-to-year (Figure 1). This could be the result of persistent high-demand in a market where supply is very low, which might ultimately lead to a market rebound in the near future.

For more information on latest housing trends in San Francisco check out our latest production of CAR’s market updates:

Sales of existing single-family homes in April — the first month capturing the full force of the coronavirus — dropped a stunning 30.1% statewide and 37.4% in the Bay Area compared to the same period last year. Although median prices were more or less unchanged.

Figures 2 and 3 compare April 2019 and 2020 Bay Area single-family homes and condo prices. The data confirms that not only have prices not decreased, in many cities they’ve slightly increased.

On March 17, San Francisco became the first US city to lockdown in response to the coronavirus pandemic. In late April, it was announced that the shelter-in-place order would be extended through the end of May.

Patrick Carlisle, chief market analyst for the San Francisco Bay Area at Compass stated in a recent report: “After the initial, terrible shock to the market, agents, buyers and sellers have been slowly figuring out how and when listings can still be safely seen by buyers; offers made, reviewed and accepted; and all the typical escrow requirements—inspections, appraisals, closing—can proceed.”

Buyers have adjusted their behavior by looking through disclosure packets and taking a virtual tour before seeing a home in person. This additional screening eliminates a lot of non-serious buyers, suggests East Bay realtor Deidre Joyner.

“In our niche market we have older housing stock and it is not unusual for an older home to have repair recommendations,” she explained. “If a buyer can rule out a home based upon a property inspection report, then we are weeding out potential buyers who were likely never going to write an offer.”

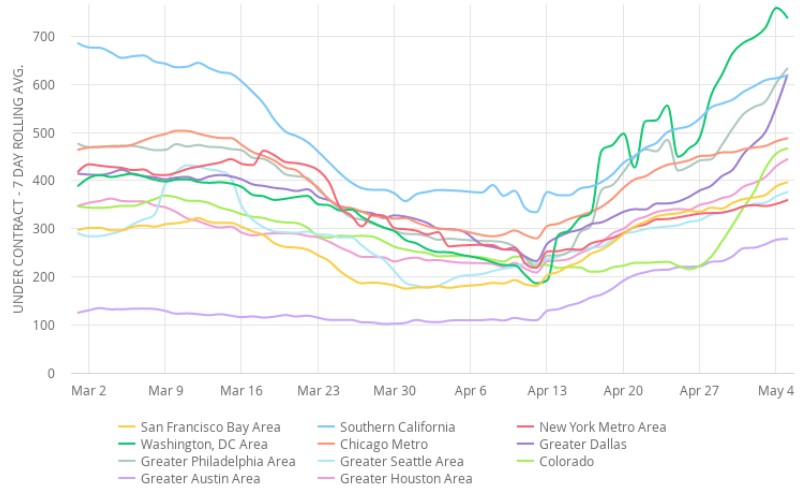

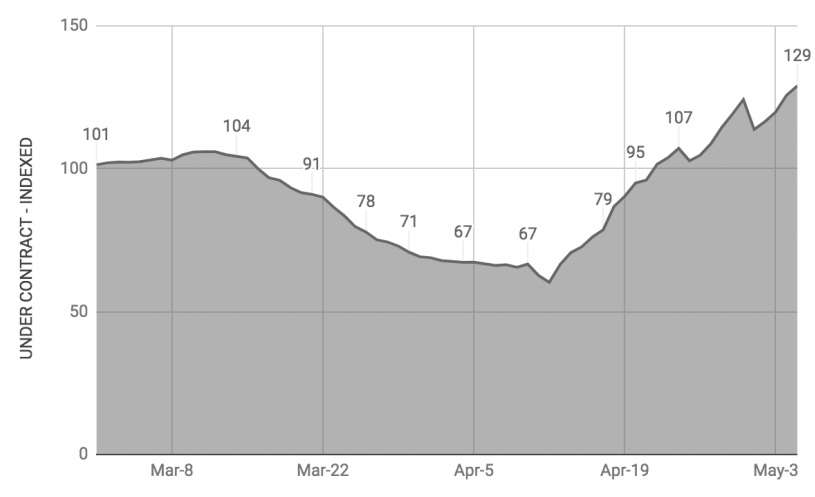

A recent report published by Compass Real Estate in May 2020 uses “under contract listings” as the most useful indicator of buyer demand in the US housing market. It showed that the real estate market reached its lowest-point in many cities in the US sometime between March 31 and April 13.

The most dramatic decline was seen in Greater Seattle, as well as New York and Washington, D.C. Metro Areas where under contract listings declined 49% from pre-COVID levels. The most impressive rebound, however, has been in the D.C. Metro Area, where under contract listings have climbed 149% since reaching the bottom.

An indexed value of the number of under contract listings for the San Francisco Bay Area can be found in figure 5. Under contract listings reached their nadir on March 31, down 39% from pre-COVID levels. By April 20, the number of listings under contract had returned to pre-COVID levels. And as of May 5, the number of listings under contract had increased 66% since the low-point, and are 27% higher than they were pre-COVID.

“Moving away from the central core has traditionally offered affordability at the cost of your time and gas money. Relaxing those costs by working remotely could mean more households choose those larger homes farther out, easing price pressure on urban and inner suburban areas,” said Zillow senior principal economist, Skylar Olsen.

“However, that means they’d also be moving farther from a wider variety of restaurants, shops, yoga studios and art galleries. Given the value many place on access to such amenities, we’re not talking about the rise of the rural homesteader on a large scale. Future growth under broader remote work would still favor suburban communities or secondary cities that offer those amenities along with more spacious homes and larger lots,” she added.

“Not surprisingly, those who truly need to buy and sell have never left the marketplace,” Dana Rice, a Washington D.C.-based senior vice president at Compass, said in a statement. “And now that the ‘new normal’ is in place, buyers are coming back and sellers are still listing properties.”

Based on a May 12th CBS SF Bay Area report, there were 12.4% more expensive and 13.3% more affordable listings last week than the week before in the San Francisco Bay Area real estate market. And while the number of new listings overall was still down 37.1% from a year ago, they were up 18.3% from the previous week.

Further, there was some good news for potential buyers: the median list price was $904,188, down 0.9% from last year. “Sellers with higher-priced homes, who often have more flexibility in their decision, appear to have held back at first to wait out the uncertainty, and are now coming back into the market with signs of increased buyer demand,” Zillow said in a news release.

“The number of [home] sales were down by 13 to 20 percent in April, that’s a big number, but the beautiful thing is that the April reports were better than expected because prices were up on average 4 percent,” Barbara Corcoran recently told FOX Business, noting the challenge real estate agents face by not being able to show homes in person.

“There’s going to be a migration — at least short term — from the city areas. If you look at New York City, Miami and San Francisco, those sales numbers are down 40 percent, that’s so much more dramatic compared to everywhere else,” Cocoran told FOX Business’ Neil Cavuto. “I don’t think you’ll see those city areas recovering quite as well as people are hoping they’re going to.”

Cocoran says that as big tech companies such as Twitter and Google allow employees to work from home indefinitely, there is a tendency for potential buyers and sellers to have more housing and commercial space. “People have adjusted to actually working at home. It really has changed the desire to commute,” Cocoran said. “You’ll even find that employers are going to say, ‘Why am I going to fight that if people are being productive at home.’”

Another report by Zillow suggested that three-quarters of Americans working from home because of the coronavirus say they want to continue if given the option. And two-thirds say they would consider moving if given that flexibility. Larger homes with more rooms and offices could draw those longer worried about their commute out of urban cores and into the suburbs and exurbs.

It can be expected that following the first 21st-century pandemic, the public’s tendency would be towards buying in the residential real estate market in the suburbs instead of more populated downtown areas where there’s a higher chance of being exposed to another high-risk epidemic.

As we come to understand the first batch of real feedback from the work-from-home experience — something that has always been suggested as a way to reduce traffic, CBD’s high densities, and for the sake of public health — it would appear that working from home is a tenable option for many companies, certainly high-tech companies. This could lead to a further slump in commercial real estate that could foreshadow the future of the San Francisco Bay Area real estate market as well.

*Image by David Mark from Pixabay